Survey for 8171 Ehsaas Program 25000 Registration Online Through CNIC | BISP Web Portal

Discover Latest News

Latest Updates Regarding Punjab Laptop Scheme Registration

Punjab Laptop Scheme 2024 Punjab Chief Minister Maryam Nawaz Sharif has formally launched the Punjab Laptop Scheme for promoting education in the country’s most populous region. During this, while presiding over a meeting recently, he set a target to provide laptops to the students within 90 days to the concerned institutions. So, if you also belong to the province of Punjab and you are studying in any government or private institution, here you will get to see complete information in this regard. Because this time the government of Punjab has decided to give laptops to students of government institutions as well as students of private

Chief Minister Punjab Free Solar Panel Scheme Online Registration Started – Know Complete Details

Chief Minister Punjab Free Solar Panel Scheme Good news! Punjab Chief Minister Maryam Nawaz Sharif has launched the CM Punjab Free Solar Panel Scheme, in which 1lakh consumers of Punjab will be given free 2KV solar panels. Punjab Chief Minister Maryam Nawaz Sharif has formally inaugurated the Punjab Free Solar Panel Scheme. Punjab consumers can apply from home through SMS or online banking from today. The Free Solar Panel Scheme is aimed at providing permanent relief to the public from expensive electricity. Consumers consuming up to 200 units of electricity per month across Punjab will be given free solar panels. 52019 consumers consuming 100 units

Join Pak Army as Captain 2025 – Online Registration – Pak Army Jobs

Join Pak Army as Captain 2025 Join Pak Army as Captain 2025: Captain Jobs 2024 has been issued by Pakistan Army Direct Short Service Commission DSSC intake. Registration is opened from 02 December 2024 and closed on 31 December 2024. for the male citizens of Pakistan through all Provinces of Punjab, Sindh, KPK, Balochistan, AJK, and FATA with Gilgit Baltistan are being accepted online at their official website www.joinpakarmy.gov.pk. Pak Army might declare various jobs are open for men only for the literal broadcasts from Military Training Expert, Law Officers, Psychologist Officers, Regiment Veterinary and Farms Officers (ReV & FO) Join Pak Army as Captain

Honhaar Scholarship Program Payment Distribution and Phase 2 Details Complete Information 2024

Honhaar Scholarship Program initiated by the Punjab government of Chief Minister Maryam Nawaz Sharif is a ray of hope for the talented and worthy students. This scholarship has been formulated to get rid of financial barriers for such students by providing financial facilities to students for the further study in the great universities of Pakistan. CM Maryam Nawaz stresses education as the foundation for a successful country, saying the scholarship scheme is not an act of charity but the right support system for meritous students. This scholarship program targeting public and private universities created opportunities that previously were not possible for most students, who can

Ministry of Defence Jobs 2024 – Apply Online Through www.njp.gov.pk

Ministry of Defence Jobs 2024 Ministry of Defence Jobs 2024:Ministry of Defense Jobs 2024 regarding theMinistry of Defense Jobs 2024The Ministry of Defence has a place for everybody starting from the managerial post right to engineering post. It all is well said if it includes any kind of job role looking into your career such as Cyber security, intelligence analysis, logstics or even managing some project. Information of the Ministry of Defence MOD Jobs 2024 Ministry of Defence (MOD), Government of Pakistan, is announcing this recruitment. All these vacancies are mostly advertised as Job Notices. Through this advertisement, we invite applications from eligible candidates on

Punjab Offers Free Insulin For Type-1 Diabetes Children

Good news for Punjab citizens who suffer from diabetes or who have a child born with Type-1 diabetes. They are now eligible to join the Punjab Free Insulin Program. This way, when they apply for the Maryam Nawaz Insulin Program, they will receive their insulin at their doorsteps. Punjab Provides Free Insulin To Type-1 Diabetes Kids! Read this article and learn the important update regarding free insulin and its registration procedure. Punjab Govt. Initiates Free Supply Of Insuline حکومت پنجاب نے حال ہی میں ایک ناقابل یقین اقدام متعارف کرایا ہے، جو پاکستان کی تاریخ کا پہلا قدم ہے، جو کہ بہت زیادہ تعریف کا

Punjab Announces Electric Taxi Scheme to Curb Pollution in 2024-25

Punjab has initiated an innovative program to combat increasing air pollution while creating jobs for unemployed people. The innovative scheme is aimed at introducing electric taxi service where most of the online taxis would be converted into electric vehicles (EVs). The scheme would benefit the drivers as well as the environment. Under this scheme, electric vehicles will be made available to drivers through affordable options such as down payments or easy installments. This initiative is expected to transform urban transportation in Punjab by reducing fuel costs and promoting sustainability. Feature Details Eco-Friendly Fleet Transition to electric vehicles to reduce emissions. Affordable Plans EVs available through

Good News: Punjab Announces Electric Taxi Scheme to Curb Pollution

The Punjab government has initiated an electric taxi scheme in the region to curb air pollution and create employment for unemployed citizens. The project intends to transform the traditional online taxis into eco-friendly electric vehicles that can be made accessible to drivers with attractive financial plans. The taxis will save on pollution and cut the costs of fuel, hence helping the drivers save. Feature Details Eco-friendly Fleet Electric vehicles to lower emissions Affordable Plans Down payment or easy installment options Economic Benefits Up to 40% savings on fuel costs Employment Boost Job opportunities for unemployed drivers This scheme is a step toward a greener future

Re-Apply In Punjab Green Tractor Scheme For Free Laser Land Levelers (GTS)

Re-Apply In Punjab Green Tractor Re-Apply In Punjab Green Tractor Scheme Punjab farmers have received some good news as the Chief Minister Maryam Nawaz Sharif has re-launched the Punjab Green Tractor Scheme GTS. This scheme is supposed to help wheat farmers by offering free green tractors and laser land levelers. The initiative will save the farmer’s cost, increase productivity, and improve agriculture practices. If you’re a farmer cultivating wheat, this scheme is a golden opportunity to receive assistance. Let’s explore the details, including eligibility criteria, registration procedures, and key benefits. There is good news for the farmers of Punjab, the registration of the Green Tractor

CM Punjab Climate Leadership Development Internship Program Jobs 2024 – Online Apply

CM Punjab Climate Leadership Development Internship CM Punjab Climate Leadership Development Internship: Internship Apply CM Punjab Climate Leadership Development CM Punjab Climate Leadership Development Internship Program 2023 They are trained on data till October 2023. Job Advertisement for batch-III of the Punjab Internship Programme, the Environment Protection and climate change department government of Punjab are offering several internship jobs with the title of subject “Chief Minister Punjab Leadership Development Internship Program 2024-2025″. Fresh Graduate Candidates for jobs in the Environment Protection and Climate Change Department. This internship is to help you become a leader and enhance your skills. CM Punjab Climate Leadership Development Internship Details

How to Register for the 8171 Ehsaas Program

If you qualify and wish to register for the Ehsaas Program and BISP, follow these steps:

Visit the Official Website or the Nearest Ehsaas Centre: Begin your registration process here.

Complete the Registration Form: Accurately fill out the form with your financial details.

Submit Required Documents: Include necessary documents such as CNICs, pay certificates and other relevant papers.

Verification Process: Submit the form and documents for verification.

8171 Ehsaas Program Registration Online in 2024

The 8171 Ehsaas program registration is now enabled online. One can use the easy code 8171 for registration. It has been initiated to continue smooth provision of social welfare benefits and is available for eligible citizens of Pakistan.

8171 Registration. This enables applicants to apply for the Benazir Ehsaas Program. The applicant uses their cell phones. This is possible from all over the country. This way, it minimizes processes that eliminate the lengthy lines and documentation procedure. It is easier to enroll and receive assistance.

Registration can be done without sending any cumbersome paper work, one just needs to send his or her CNIC number to 8171 through SMS; after the registration, a confirmation message will arrive saying more details of how to utilize the facility of this program. It means this streamlined system is making sure of speedy and hassle-free enrollment.

Online registration also improves transparency and accountability in the Benazir Ehsaas Program. All registrations are digitally logged to avoid errors and fraud. The digital record easily traces all beneficiary beneficiaries. It channels assistance to those who are really distressed

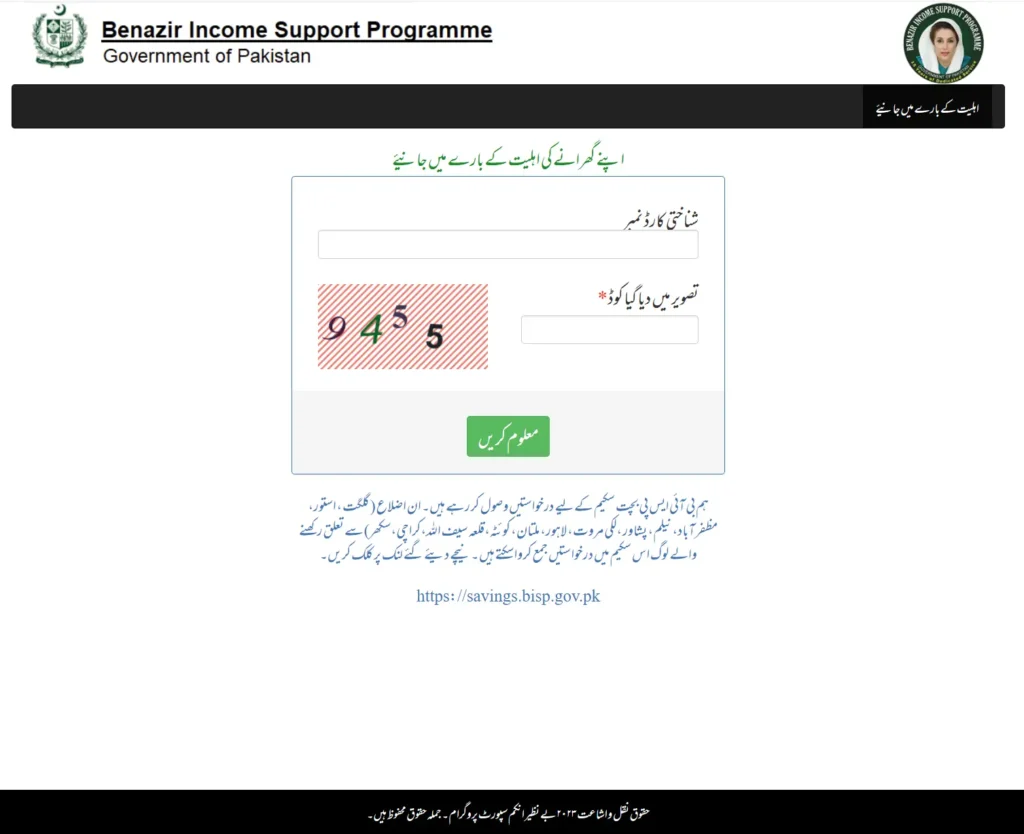

Ehsaas Program CNIC Check Online Registration

Ehsaas Program CNIC check online registration for 25000 now available. This website portal would allow checking the online registration of Ehsaas Kafalat and payment of Rs. 25000. In addition, you will be able to check CNIC registration through web portals 8171 for the Ehsaas programme.

The government of Pakistan has made all efforts to remove poverty and social welfare of احساس پروگرام for the country of Pakistan. So, if you are looking for Ehsaas emergency cash online registration 2024 then you are definitely at the right webpage.

We shall guide you on how to check your eligibility and how to apply for the BISP 8171 Ehsaas emergency cash program.

نئے25000 8171 سروے کے لیے یہاں کلک کریں۔

Ehsaas Program Registration 8171 NADRA for 25000 cash is a social welfare package instituted by the Pakistan Government. This financial initiative has been brought into operation to alleviate monetary issues amongst the deprived classes of Pakistan. Ehsaas Program 8171 online check 2024 consists of a cash transfer program through a web portal and Online registration, emergency cash assistance, and much more.

Suppose you are searching for your application status or payment through the tracking Ehsaas web portal helpline 8171. In this case, you can contact the helpline and provide your National Identity Card number or 8171 Ehsaas Programme 25000 CNIC Check online portal number to the representative, who will then be able to inform you about your present application status or your payment.

آن لائن 8171 رجسٹریشن 25000 نئے سروے کے لیے یہاں کلک کریں۔

The Ehsaas Program Registration 8171 NADRA for 25,000 cash is the Government of Pakistan’s social welfare scheme intended for underprivileged and weaker segments of society. The cash transfer through the web portal online registration, emergency cash, amongst other initiatives, contains the Ehsaas program 8171 online check 2024.

You may utilize the Ehsaas tracking 8171 web portal helpline for checking up on the status of your application or your payment. You can call their helpline and provide them with the number of your National Identity Card, or you may share the number 8171 Ehsaas Program 25000 CNIC Check Online Portal Number with them, and they will provide you with the latest details on the status of your application or payment.

Government of Pakistan 8171 Registration online Check Web Portal

To sign up for the Ehsaas Program 8171 NADRA, follow these steps on the official Ehsaas government website:

Visit the web portal at https://8171.bisp.gov.pk.

If you have a reference number, enter it and click on ‘Check My Status.’ If not, proceed to the next step.

Enter your CNIC number in the first box.

Type the number displayed in smaller text on the left side into the box below.

Click on the green button.

Your eligibility status will be displayed.

Once eligible, you will receive an SMS notification for the first installment of 14,000.

Families eligible for various cash amounts, such as RS 25,000, RS 7,000, RS 2,000, RS 4,000, RS 12,000, RS 8500, RS 35,000, and more, are already registered based on the Benazir National Socio-Economic Registry survey. You can apply online at the 8171 web portal for 2024.

Key Features of Ehsaas Program 8171 Web Portal

The programs under Ehsaas 8171 focus incorporate a variety of initiatives and interventions to fight diverse dimensions of poverty and inequalities. Some key features of the program include the following:

- Cash Transfer Programs: Offering the payment under a number of Ehsaas programs, such as Ehsaas Kafaalat, Ehsaas Amdan, and Ehsaas Emergency Cash, 8171 is a program of cash transfers. Under this program, direct cash assistance at a specific amount is given to more than five million deserving households to cater to their basic fundamental needs, including food, medical health, and education.

- Social Protection Programs: The program adds social protection measures to its list with Ehsaas Langar, Ehsaas Nashonuma, and the Ehsaas Interest-Free Loans. These are all forms of safety nets for vulnerable populations – children, pregnant and lactating women, and otherwise marginalized communities – where shocks and vulnerabilities in these areas can be safeguarded against.

- Education and Health Programs: The Ehsaas Program 8171 focuses on human capital through education initiatives like Ehsaas Education Stipends, Ehsaas Undergraduate Scholarships, and the Ehsaas Health Insurance programs for the alleviation of access to quality education and health services for poor children and youth, which are long-term prospects for quality life.

- Economic Empowerment Programs:

It includes economic empowerment features such as Ehsaas Interest-Free Loans, Ehsaas Langar, and Ehsaas Amdan. All these give entrepreneurship, skills development, and livelihood support opportunities to the poor and improve their sustainable income generation and break the poverty cycle.

Objectives of the 8171 Ehsaas NADRA Gov Pk Program

The main objectives of the 8171 Ehsaas NADRA Gov Pk program are:

- To provide financial assistance to the needy and vulnerable segments of society

- To reduce poverty and improve the standard of living of the beneficiaries

- To create job opportunities for the unemployed and underemployed

- To improve access to basic services such as education, health, and sanitation

Eligibility Criteria

To be eligible for the 8171 Ehsaas NADRA Gov Pk program, an applicant must meet the following criteria:

- Must be a resident of Pakistan

- Must be living below the poverty line

- Must not be receiving any other form of government assistance

Ehsaas Program New Online Registration

The application process for the Ehsaas Program Online Registration is as follows:

- Visit the official NADRA website at www.nadra.gov.pk

- Click on the “Ehsaas Web Portal” tab

- Fill out the application form with all the required information

- Submit the form along with the required documents

- Wait for the verification process to be completed

- If eligible, the applicant will receive a message on their registered mobile number with the details of the assistance amount and disbursement date

Conclusion

The Ehsaas NADRA Gov Pk is a program offered by the government for the support of poor and needy segments in the society, and it has been initiated by the National Database and Registration Authority (NADRA) on behalf of the Ministry of Poverty Alleviation and Social Safety.

Interested persons can apply for this program through the official website of NADRA after downloading an application form. The necessary documents should also be attached to the form. The program aimed at the alleviation of poverty and improvement in the standard of living amongst its beneficiaries.

FAQ’s

Who is eligible for the Ehsaas program?

If you’re 18 years old or above and belong to a family of impoverished and needy individuals, then you qualify for the Ehsaas program. To confirm your eligibility, visit the Ehsaas online portal or send your CNIC number to 8171.

What is the WhatsApp number for 8171 Ehsaas?

The Ehsaas Program in Pakistan does not have an official WhatsApp number for communication with the general public. However, the program does provide information and updates about its initiatives and services through its official website (http://8171.pass.gov.pk/).

Who is the head of the Ehsaas program?

The Ehsaas program in Pakistan is headed by Dr. Sania Nishtar, who is the Special Assistant to the Prime Minister of Pakistan on Poverty Alleviation and Social Protection.

What difference between ehsaas 8171 and BISP 8171?

The Ehsaas program and the Benazir Income Support Program (BISP) are both social welfare initiatives launched by the Government of Pakistan to provide financial assistance and social protection to the poor and vulnerable segments of society.

How To Check Benazir’s Income 10500?

To check Benazir’s Income Support of 10500, wait for a message from 8171 confirming the cash transfer to your account, or directly check your account for the transaction.

How Do I Verify My CNIC for the Ehsaas Program Online?

Simply go to the official website, and enter your CNIC and mobile number. Alternatively, send your CNIC to 8171. You’ll receive a confirmation message shortly.

How Can I Get Money from the Ehsaas Program?

You can get your Ehsaas money from special ATMs with fingerprint recognition, HBL service points, and specific locations.

How do I check my Ehsaas program eligibility online for 2024?

Visit 8171.bisp.gov.pk, Enter your CNIC and mobile number to check Ehsaas program eligibility for 2024. Await confirmation or view the status on the website.